CMS’ Latest Rate Notice: A Welcome Boost for Medicare Advantage Plans

By: Ali Yousuf, Product Manager & Morgan Olsen Jaciuk, Senior Product ManagerKey insights and strategies for Medicare Advantage plans looking to make the most of CMS’ 2026 Medicare Advantage latest rate notice.

The Centers for Medicare and Medicaid Services (CMS) ’s Final Rate Announcement for 2026 includes several key figures that point to a more favorable financial environment for Medicare Advantage (MA) plans. The effective growth rate of 9.04%—which reflects projected growth in per-person Medicare costs—is significantly higher than expected, driving an estimated average revenue increase of 7.16% for MA plans once coding trends are factored in.

The Centers for Medicare and Medicaid Services (CMS) ’s Final Rate Announcement for 2026 includes several key figures that point to a more favorable financial environment for Medicare Advantage (MA) plans. The effective growth rate of 9.04%—which reflects projected growth in per-person Medicare costs—is significantly higher than expected, driving an estimated average revenue increase of 7.16% for MA plans once coding trends are factored in.

This large jump on paper seems to offer much-needed relief to Advantage plans after years of squeezed margins, rising healthcare utilization, and growing financial pressures.

However, given the challenges plans are facing today, will it be “enough” to drive true revenue growth in 2026?

To help explore this question, Unite Us’ Medicare experts conducted a deep-dive analysis of the announcement and available data—and found that Advantage plans are likely to see their largest payment increases in years.

Many MA plans could see a meaningful boost in revenue based on the announced rates, with increases that may outpace the average increase in claims expense in 2026.

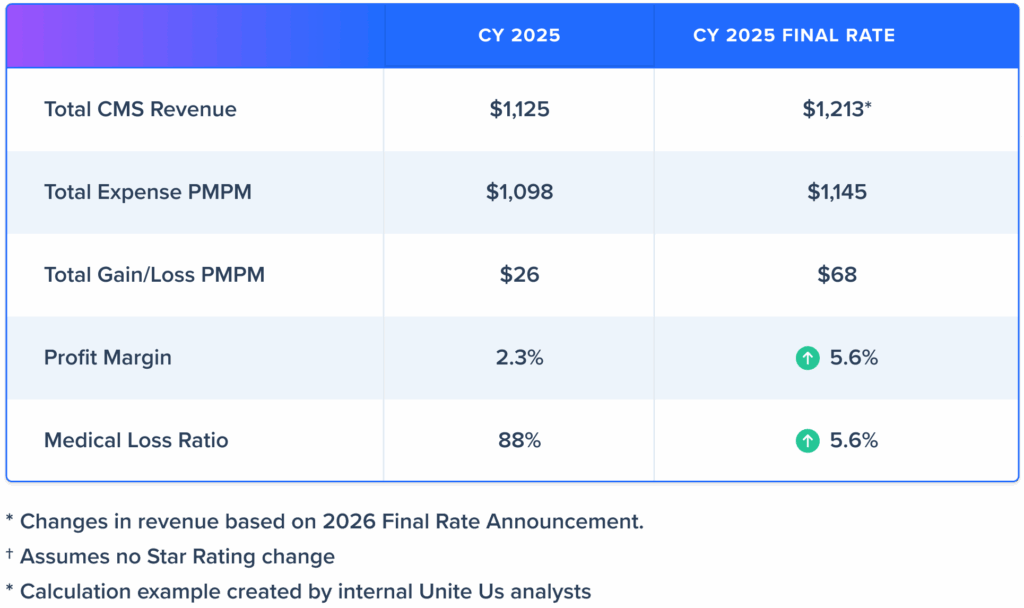

To give an illustrative example, we estimate that a plan with an 88% medical loss ratio (MLR) in 2025 could see an improvement to an 85% MLR with the 2026 Final Rate.

Estimated Profit Calculation Example

What does this mean for Medicare Advantage plans?

The Final Rate Announcement enhances the financial outlook for MA plans. Though plans may have experienced shrinking margins in the past few years, this year appears to offer greater financial flexibility than in recent memory, even for plans anticipating shrinking margins or expecting a loss in Star Ratings. This allows MA plans more opportunity to focus on growth in the coming quarters.

As plans prepare for the increase in revenue, now is the time to think strategically about your 2026 vision and develop strong plan offerings as well as invest in value-driving initiatives that help you reach your goals and secure a lasting competitive edge.

Here are key areas where the additional revenue—and the added planning time it allows—can make a meaningful impact for your plan:

Use 2025 and 2026 to solidify your approach to member engagement. Go beyond fragmented outreach efforts to implement a coordinated, end-to-end strategy that strengthens member relationships, drives behavior change, and improves plan performance across Star Ratings, retention, and health outcomes.

![]() Invest in actionable insights and data tools that allow you to understand members, capturing geographic factors, clinical risk, and behavioral and non-medical risk factors that may affect adherence and condition management. Leverage data and insights to align welcome kits and initial outreach based on language, cultural norms, and known health needs. Highlight key benefits (e.g., dental, transportation, drug) from day one to improve member satisfaction and early engagement.

Invest in actionable insights and data tools that allow you to understand members, capturing geographic factors, clinical risk, and behavioral and non-medical risk factors that may affect adherence and condition management. Leverage data and insights to align welcome kits and initial outreach based on language, cultural norms, and known health needs. Highlight key benefits (e.g., dental, transportation, drug) from day one to improve member satisfaction and early engagement.

![]() Establish a proactive, consistent engagement cadence. Implement a member engagement framework that includes proactive interventions, such as care-gap reminders, preventive screening nudges, or benefit utilization reminders that unify health needs, providers, and key benefits. This approach helps improve care delivery and outcomes, reduce churn, and support Star Rating performance, contributing to long-term plan viability beyond 2026.

Establish a proactive, consistent engagement cadence. Implement a member engagement framework that includes proactive interventions, such as care-gap reminders, preventive screening nudges, or benefit utilization reminders that unify health needs, providers, and key benefits. This approach helps improve care delivery and outcomes, reduce churn, and support Star Rating performance, contributing to long-term plan viability beyond 2026.

![]() Lock in and deploy a meaningful retention strategy with insights from membership data, Medicare-aged personas, and predictive analytics. Use segmentation to better understand your core members and key geographies and identify those members at risk of disenrollment, intervening with tailored messaging and support that reinforces your value proposition and builds loyalty. If needed, reroute members to alternative plan options that better suit their needs. Streamlining core membership enrollment will facilitate plan success long-term.

Lock in and deploy a meaningful retention strategy with insights from membership data, Medicare-aged personas, and predictive analytics. Use segmentation to better understand your core members and key geographies and identify those members at risk of disenrollment, intervening with tailored messaging and support that reinforces your value proposition and builds loyalty. If needed, reroute members to alternative plan options that better suit their needs. Streamlining core membership enrollment will facilitate plan success long-term.

Develop value-based contracts and expand care-management teams to drive quality improvements and lower downstream costs in the future. Offering incentives for care gap closure, annual wellness visit completion, and chronic condition capture will strengthen plan performance in the long run.

Right-size your plan benefit packages and pricing while you have financial flexibility—understand where to divest and where to invest to drive member satisfaction and outcomes, and the long-term viability of your plans. Plans should analyze their market and core member needs to create benefits that truly resonate locally, while also offering tailored education initiatives to help members understand and utilize their benefits effectively.

Attract and enroll core members who will drive your plan into the future. Leverage predictive analytics and Medicare-specific personas to uncover actionable insights and tailor outreach. Understanding your audience’s preferred channels helps make sure your engagement resonates with your population and makes your marketing dollars go further.

Investing your additional CMS revenue toward member-focused initiatives can drive healthier populations long term and boost your plan’s reimbursements and bonus payments—driving plan success in 2026 and beyond.

Unite Us: Your Partner for Smarter Medicare Advantage Growth

Unite Us Insights Growth provides the predictive insights and consumer segmentation, market and benefit data, and operational support to turn CMS’s payment increase into measurable improvement across enrollment, engagement, retention, and profitability. By leveraging advanced predictive analytics, you can accelerate plan benefit design, tailor outreach, and keep members healthier and more engaged.

Unite Us Insights Growth provides the predictive insights and consumer segmentation, market and benefit data, and operational support to turn CMS’s payment increase into measurable improvement across enrollment, engagement, retention, and profitability. By leveraging advanced predictive analytics, you can accelerate plan benefit design, tailor outreach, and keep members healthier and more engaged.

As you plan for 2026, consider how a comprehensive, data-driven growth strategy can transform this 7.16% payment bump from a temporary financial boost into a foundation for sustained performance. With the right mix of investment, analytics, and tailored insights, your plan can become stronger and deliver better outcomes for members while solidifying your competitive position in the Medicare Advantage market.